These contain R&D, executive salaries, travel and training, and IT bills. It is on your business’s steadiness sheet that the costs are accounted for. First, the original value could be reported, then accrued depreciation can be subtracted from it, with the result giving you the e-book worth of your asset. The utilities expense incurred by a company’s manufacturing operations is considered a part of its factory overhead. As such, the expense is amassed in a cost pool after which allocated to the items produced in the period when the expense was incurred. If not all units produced are sold in the period, this means that a variety of the utilities expense will be recorded as part of the inventory asset, somewhat than being instantly charged to expense.

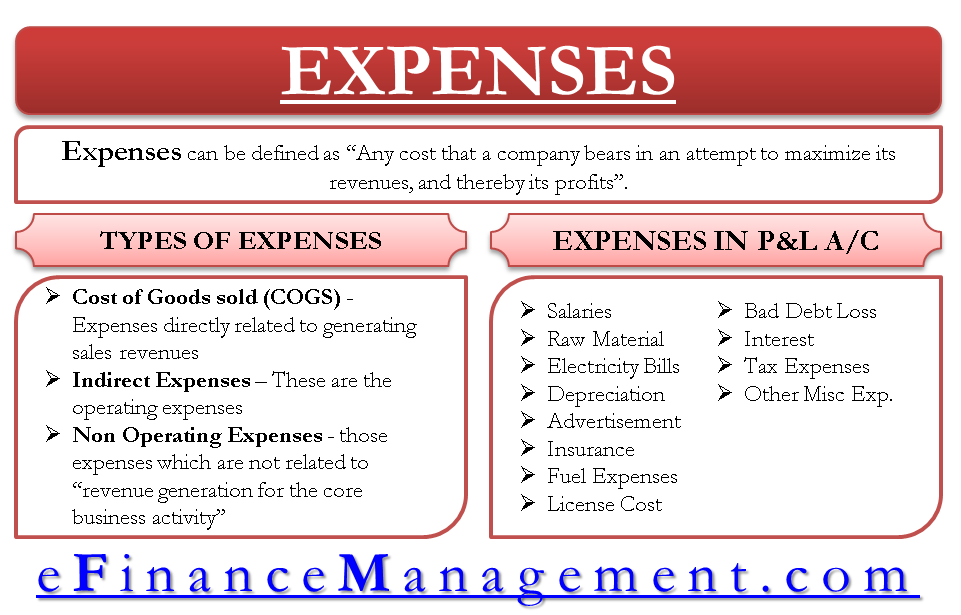

Below is a break down of subject weightings in the FMVA® financial analyst program. As you can see there is a heavy give attention to financial modeling, finance, Excel, business expense definition in accounting valuation, budgeting/forecasting, PowerPoint displays, accounting and business technique. The most common approach to categorize them is into operating vs. non-operating and stuck vs. variable. Ramp helps you cut prices by identifying financial savings alternatives and imposing good spending controls. It additionally ensures correct reporting, faster approvals, and improved money flow visibility—all in one place. Prices immediately tied to working a business, similar to rent, salaries, utilities, and marketing.

Tax-deductible Business Expenses

This helps draw a clear line and separate bills between accounting intervals. Corey’s Food Truck, Inc. is a neighborhood food firm that delivers sandwiches on the Santa Monica beach. When Corey places his order, he debits provides for $100 and credit money for $100. This journal entry records the asset, money, getting used as a lot as generate revenues by making sandwiches. Usually, bills are debited to a specific expense account and the normal balance of an expense account is a debit steadiness. Extraordinary expenses are costs incurred for big one-time events or transactions exterior the firm’s regular enterprise exercise.

- Thus, a company could make a $10,000 expenditure of money for a fixed asset, however the $10,000 asset would only be charged to expense over the term of its useful life.

- Non-operating expenses are not instantly tied to main enterprise operations.

- Nevertheless, there are some that are non-cash expenses like depreciation, during which case they’re accounted for in other related monetary statements.

- The capitalized software program costs are recognized equally to certain intangible belongings, as the prices are capitalized and amortized over their helpful life.

- Evaluate expense accounts monthly or quarterly to catch errors, establish duplicate expenses, and guarantee entries are posted to the right interval.

Expenses are categorized to offer a clearer picture of a company’s monetary operations. At the top of the 12 months, Corey spends a complete of $5,200 on deli meat and lists this as an expense on his income assertion. Figure 2 graphically illustrates the classification of expenses related to the odd activities of the enterprise. Examples of COGS embody direct materials, direct costs, and manufacturing overhead. Typically we get the annual or quarterly invoices from Vendors https://www.kelleysbookkeeping.com/, which we’ve to pay in advance. We also must spread these bills over the corresponding interval whereas recognizing them in the books.

What Are Working Expenses? Small Enterprise Information

Prepaid bills are initially recorded as property, however their value is expensed over time onto the earnings statement. Not Like standard bills, the enterprise will obtain something of worth from the prepaid expense over the course of a number of accounting intervals. Whereas the revenue assertion reveals when expenses are incurred, the cash move assertion particulars when cash is paid for these bills. This statement categorizes money flows into working, investing, and financing actions. Money funds for operating expenses, such as salaries, lease, and utilities, are included in the operating actions section. This supplies an important link between a company’s profitability and its liquidity.

Regardless how they are categorized, the whole bills are calculated and subtracted from the entire revenues to calculate the net revenue for the interval. For occasion, if a corporation employing the money foundation schedules a carpet cleaner to scrub the carpets within the office, the expense is recorded when the invoice is paid. When the enterprise obtains the carpet cleaning service, the accountant would record the expense using the accrual approach.

Thus, an expenditure typically happens up entrance, whereas the popularity of an expense could be spread over an prolonged time period. This offers you a clearer view of your company’s financial health by aligning revenues with corresponding expenses within the same time frame. Accrual foundation accounting acknowledges bills when you incur them quite than when you pay for them.

Delving Into Accrued Expenses: Key Insights

Examples of bills embody hire, utilities, wages, upkeep, depreciation, insurance coverage, and the worth of items offered. Working bills are deducted from revenues to arrive at working income, which is the amount of profit an organization earns from its direct enterprise actions. In quick, the accrual basis of accounting accelerates the recognition of utilities bills in comparison to the cash foundation of accounting.

Digitize receipts (either by scanning them or taking a photo) and store them securely in an accounting system or cloud storage answer. Develop guidelines for allowable bills, spending limits, and required documentation. Shaun Conrad is a Licensed Public Accountant and CPA examination professional with a passion for teaching. After nearly a decade of experience in public accounting, he created MyAccountingCourse.com to help people learn accounting & finance, move the CPA exam, and start their career. Learn how small businesses can handle bookkeeping effectively and scale faster with clear books. Visualize the way your money moves, and transfer your business like an skilled.

We’ll clarify what expense accounts are, talk about their purpose in financial accounting, provide widespread examples, and dive into greatest practices to better manage business spending. Fastened expenses remain fixed regardless of enterprise exercise, similar to month-to-month hire or insurance premiums. Variable expenses fluctuate with the amount of production or sales, like the value of uncooked materials. This categorization aids budgeting and understanding how prices behave as business exercise adjustments. Common and administrative bills embody expenses incurred while running the core line of the business and embody government salaries, R&D, journey and training, and IT bills. Evaluate expense accounts month-to-month or quarterly to catch errors, determine duplicate costs, and ensure entries are posted to the proper period.

![]()